Rental Roulette: Spotting Application Fraud

See how little it takes to fraudulently pass a rental application

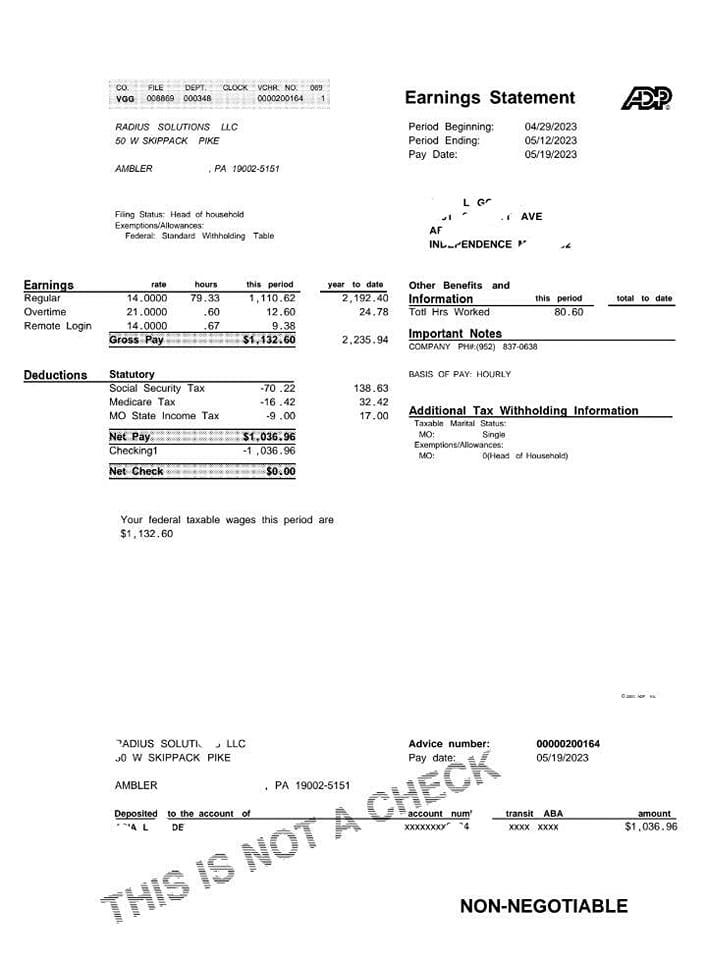

Let’s play a game: real or fake?

Don’t scroll too fast or you’ll see the answer

And the answer is…

If you voted fake (congrats!), what did you see to know that it was fake? Besides the scratched out name and account number (to protect the fraudster 😂), it looked pretty legitimate to the naked eye.

Seeing is not believing

Scary statistics

Document fraud is rising fast and scammers are constantly improving their techniques. TransUnion says that 1/7 applicants had a fraud trigger in 2020 - and it’s only gotten worse since.

“11 million fraudulent rental applications were submitted last year in the U.S.” -Snappt

How easy is it

In fact, getting fake documents is really easy. There’s hundreds of Facebook accounts and WhatsApp groups dedicated to it.

And cheap too

Looks like the going rate is $25 for paystubs and $50-$75 for bank statements. They can produce them same-day and accept CashApp for payment.

Most property managers, agents and owners ask for two recent paystubs and a bank statement for income verification. For just $100 a scammer can rent your apartment.

Ok, but what’s the big deal

Best case scenario: the tenant used the fake docs to get a slightly nicer apartment than they can afford, so are always behind on the rent

Worst case scenario:

Once you approve an unqualified tenant and they sign the lease, you’re stuck with them. The only way out is via eviction and that’s a nasty process that can take months. In the meantime, your property is getting trashed, utility bills are mounting and the neighbors are complaining.

Prevention is better than cure

Like early cancer screening (this is a reminder to get your annual testing), it’s WAY better to catch the problem before it’s too late.

For an owner/agent/property manager, that means rigorously vetting every applicant before signing the lease. Let’s review potential red flags and best practices:

🚩 Red Flags

These are potential signs that the applicant is using fake documents and/or is unqualified for your property

They want to move in ASAP and expedite the process

They already have a background check and credit report that they’ll share

They say you can only call a specific phone number to verify employment

They are happy to pay higher rent or more upfront in exchange for faster application process

They want a reduced security deposit

They come from a short term rental platform (like Airbnb) and then ask to extend outside of the platform with no application process.

✅ Best Practices

If possible, meet the applicant in person and verify that their ID is real and the photo matches

Most fraud happens through online applications where it’s much easier to submit false documents

Create intentional friction in the process

Following up to verify details or ask for more documents will scare away some scammers while good applicants won’t mind too much

Run your own background check and credit report

This is the only way to be 100% confident that the information is correct

Call the employer and previous landlords to verify the information

Make sure to find the phone numbers online and take the time to fully verify income and rental history

Use ID and document verification software

Often this is not accessible to small owners and agents, but you can work with a tech-native property management company like Threshold to handle the screening.

Have an application checklist and don’t cut corners

Define your own applicant verification process and stick to it religiously, no matter how pushy they are. Most fraud happens when owners/agents skip steps to make it faster

Trust your gut but don’t discriminate

If anything feels fishy, investigate until you either feel confident or have enough suspicious evidence to reject the application with cause.

Threshold combines the latest technology to catch all types of tenant fraud (identity, income, credit and criminal) before it’s too late. Our cutting-edge property local property management saves owners thousands of dollars per year. If you or your clients own rental property in South Florida, call us at 305.602.4857 or visit us at www.thsld.com